27 Interesting Probiotics Statistics & Market Size (2025)

Medically reviewed by Amy Richter, RD.May 28, 2023

Ever feel like probiotics are everywhere right now? From yogurt aisles to TikTok wellness tips, they’ve gone from niche to mainstream, and they’ve done it fast.

But this isn’t just another health trend passing through, because the numbers tell a bigger story.

The probiotics market in 2025 is worth $85 billion. And it’s not just about yogurt and pills — we’re talking supplements, functional drinks, even skincare

1. Quick Snapshot: Probiotics Market in 2025

According to Statista, the global probiotics market is expected to reach $85 billion in 2027, a dramatic rise from $58 billion in 2022. That is driven by explosive interest in gut health, immunity, and functional nutrition.

Meanwhile, data from SkyQuest puts the 2023 market at $70.2 billion, with forecasts suggesting it could hit $141.5 billion by 2032 — a CAGR of 8.1%.

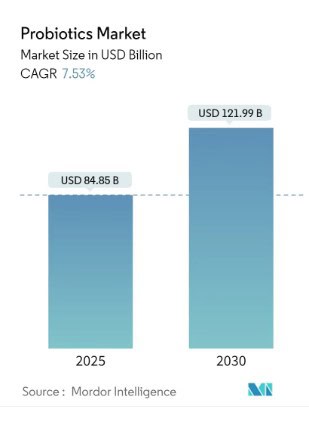

Other forecasts, such as Mordor Intelligence, suggest a CAGR of 7.53%, with projections reaching $121.99 billion by 2030.

Here are a few key figures that show what’s driving that growth:

- Functional Foods & Beverages: Still the heavyweight category, making up over 60% of total probiotic sales globally (Grand View Research).

- Asia-Pacific: Leading the global market in both volume and revenue, with countries like China, Japan, and India pushing demand through traditional and modern applications.

- Online Sales Channels: Booming post-pandemic, with Asia-Pacific’s e-commerce market for probiotics contributing significantly to the global spike.

- Top Use Cases: Digestive health remains the top reason consumers buy probiotics, but immunity, mental wellness, and even skin health are gaining traction.

In short: the market isn’t just growing, it’s expanding in every direction — across formats, regions, and consumer needs.

2. Probiotics Are Everywhere, Here’s Why

The surge in the probiotics market isn’t just a fleeting trend; they’re riding a massive wave driven by people finally paying closer attention to their health. It’s not just about fixing problems anymore; it’s about staying ahead of them. And that shift is exactly what’s pushing probiotics into the spotlight.

Health Awareness

Consumers are recognizing the link between gut health and overall well-being. This awareness has led to an increased demand for probiotic-rich foods and supplements.

Functional Foods – more than just a trend

Functional foods, which offer health benefits beyond basic nutrition, are gaining all attention. Probiotics play a significant role in this segment, with products like yogurts, kefir, and fermented beverages becoming staples in many diets.

E-commerce and Online Retail Growth

The rise of e-commerce has made probiotic products more accessible to bigger audience.

Online platforms offer a convenient way for consumers to explore and buy a variety of probiotic supplements and foods, contributing to market expansion.

Scientific Advancements and Research

Ongoing research continues to show benefits of probiotics, from supporting immune system to improving gut health. These scientific validations boost consumer’s confidence and contribute in market growth.

3. Regional Insights: Probiotics Market Around the World

The probiotics market isn’t growing evenly everywhere — some regions are pulling ahead fast, while others are just taking a start. Here’s how it breaks down, region by region:

Asia-Pacific: Still Leading the Pack

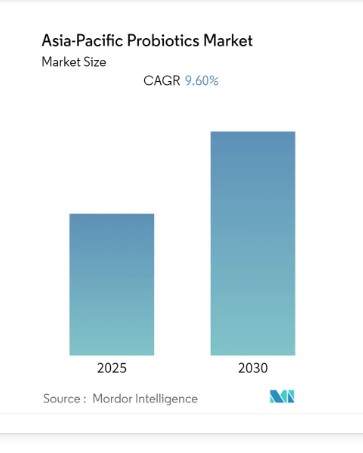

First up, Asia-Pacific — and honestly, no surprise here. The region holds the crown for the largest market share.

In 2025, its probiotics market hit $44.28 billion, and projections show it’s on track to grow at a 14.13% CAGR well into the 2030s.

Why the boom? It is the rising incomes, growing health awareness, and a cultural history that already embraces fermented foods. Countries like China, Japan, and India are leading the way.

North America: Catching Up, Fast

Meanwhile, North America isn’t slowing down. The U.S. market alone was worth $15.2 billion in 2024, and it’s all set to reach $27.8 billion aprox in 2033, with a 6.93% CAGR.

So what is causing all the hype? Simple: an obsession with gut health, personalized nutrition, and a surge in wellness trends. Add to that better formulations and quicker access via e-commerce, and you’ve got a recipe for rapid growth.

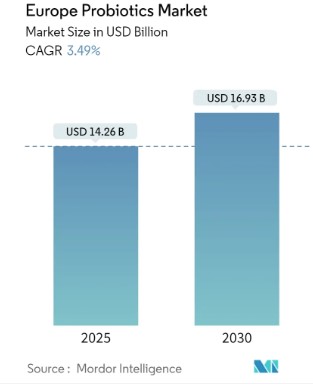

Europe: Slow but Steady

Now, over in Europe, growth isn’t as fast – but it’s solid. This market is more mature, with consumers already pretty educated about probiotics. Germany leads the way, followed by the UK and France.

In 2025, Europe is expected make up about 20.3% of the global probiotics market. Innovation is happening here too, but more in terms of personalized gut health and clinical-grade probiotics.

Middle East & Africa: An Untapped Opportunity

Lastly, we’ve got the Middle East and Africa – still in early growth stages but full of potential. As more people move into cities and get access to global wellness trends, demand for probiotics is starting to rise.

The region isn’t breaking records yet, but smart brands should keep an eye on it – especially with the growing middle class and increased focus on dietary wellness.

4. Innovations in Probiotics

Probiotics are gaining attention, and at the same time, they’re evolving. In 2025, innovation is happening on all fronts. From how probiotics are formulated to the way they’re delivered, packaged, and even personalized, everything is being reimagined.

As a result, brands are becoming more precise in addressing specific health needs, while consumers are expecting more than the usual capsule or yogurt. This category is gaining momentum, and there’s every sign it will continue to do so.

Functional Foods Are Taking Over

At the same time, functional foods and beverages such as yogurt, kombucha, and fortified snacks have caught all the attention. They now account for over 60% of the probiotics market.

While figures can vary slightly depending on the source, projections show the global probiotics market reaching $126.7 billion by 2030, growing at an annual rate of 9.8 percent from 2024. It’s clear that functional foods are playing a central role in driving this growth.

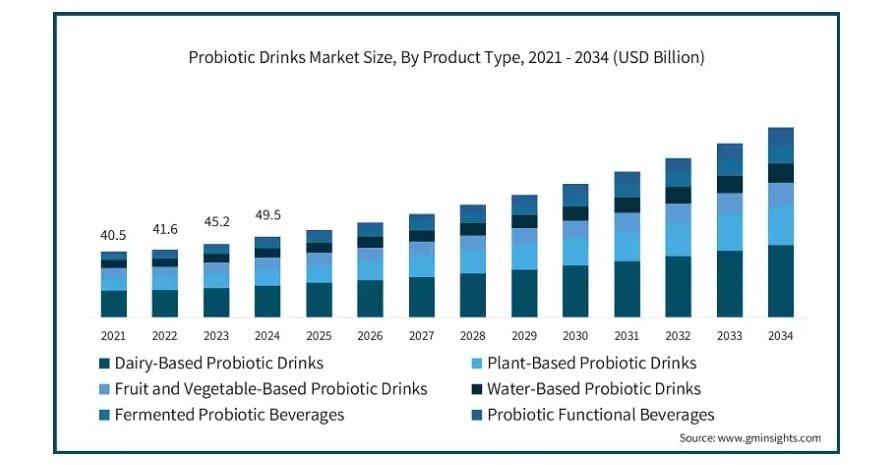

To illustrate, take probiotic drinks. The market was valued at $40.5 billion in 2021, and it’s expected to surpass $70 billion by 2034.

While dairy-based options still lead in overall sales. Moreover, plant-based and water-based alternatives are where the real growth is happening.

These newer options are gaining popularity with consumers who want more variety and better alignment with their dietary preferences.

Here the graph shows the projected growth of the probiotic drinks market from 2021 to 2034, broken down by product type.

The market was valued at $40.5 billion in 2021 and is expected to grow steadily, reaching over $70 billion by 2034.

Dairy-based drinks (like traditional yogurt-based products) still lead the pack, but the real momentum is coming from plant-based and water-based options.

As more people look for dairy-free and clean-label choices, those segments are climbing fast. You’ll also notice a steady rise in fermented and functional probiotic beverages, showing that consumers aren’t just sipping for taste, but for wellness too.

Synbiotics Are Gaining Ground

Consumers are getting smarter and they are reaching for products that actually work and that is exactly why Synbiotics ( probiotics + prebiotics) are getting popular.

The global synbiotic product market was valued at $1.02 billion in 2024 and is expected to grow at a CAGR of 8.3% from 2025 to 2030.

Gut-Brain Health = Big Business

The psychobiotics category — probiotics that target mental wellness is surging. Research-backed strains now aim to reduce anxiety, improve sleep, and even support cognitive function.

The psychobiotic supplements market, was valued at approximately $150.87 million in 2025, and is projected to reach $212.82 million by 2035, a CAGR of 3.5%.

Probiotics no longer just come in pill form

From probiotic chocolate to gummies, delivery formats are evolving. In 2024, The U.S. probiotic gummies market generated a revenue of $261.2 million and is expected to reach $541.7 million by 2030, growing at a CAGR of 13% from 2025 to 2030.

5. Major Companies in the Probiotics Market (2025)

When it comes to dominating the global probiotics space, many companies earned their place at the top through massive R&D investments, investing in research, building products people actually trust, and showing up in stores around the world.

That mix of science, scale, and staying power is what keeps them leading the pack.

Whether it’s fortified foods, advanced supplements, or patented bacterial strains, these brands are shaping what gut health looks like in 2025.

Here are the key players to watch:

- Nestlé S.A.

- Danone S.A.

- Yakult Honsha Co., Ltd.

- Chr. Hansen Holding A/S

- BioGaia AB

- Probi AB

- DuPont de Nemours, Inc. (IFF Health)

- Arla Foods amba

- Kerry Group plc

- Lallemand Inc.

- Ganeden (a part of Kerry)

- Novonesis (formerly part of Novozymes)

6. Market Segmentation & Product Types in the Probiotics Industry (2025)

From fortified yogurts to gut-boosting pet supplements, probiotics are showing up in more products and categories than ever before. Let’s break down where the biggest opportunities (and dollars) are flowing.

By Product Type:

Functional Food & Beverages: This is the market’s heavyweight. Probiotic yogurts, kombucha, and drinkable shots lead the pack, especially in Asia and Europe, accounting for over 60% of global probiotic sales.

Dietary Supplements: The global dietary supplements market is on a strong upward trajectory, expected to hit $179.53 billion in 2024. With a CAGR of 7.6%, it’s expected to grow to $258.75 billion by 2029.

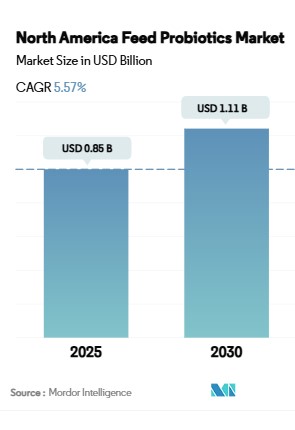

Animal Feed: Farmers are swapping antibiotics for probiotics. Livestock probiotics, helping boost immunity and productivity naturally, are projected to hit a CAGR of 6.8% from 2025 to 2034.

Bacteria-Based Probiotics:

The most widely used and researched probiotic ingredients fall under the Lactobacillus and Bifidobacterium genera.

These strains are recommended for their stability, safety, and strong clinical backing. Lactobacillus species (like L. rhamnosus and L. acidophilus) are commonly found in yogurts and cheese.

Meanwhile, Bifidobacteria play a crucial role in colon health and are often included in products targeting irritable bowel syndrome (IBS) and constipation.

Their well-documented benefits and adaptability across product formats make them the go-to bacteria for both food and pharma applications.

Yeast-Based Probiotics:

Saccharomyces boulardii stands out as the leading probiotic yeast — and for good reason. It’s been shown to help treat antibiotic-associated diarrhea, Clostridium difficile infections, and traveler’s diarrhea.

Unlike bacteria, S. boulardii survives antibiotic treatments, making it a useful option during or after a course of antibiotics. It’s also shelf-stable and heat-tolerant, which gives manufacturers more flexibility when formulating products.

By Application:

Animal Probiotics:

Probiotics are becoming essential in both pet nutrition and livestock management. For pets, probiotics are used in treats and supplements to support gut health, reduce allergies, and improve nutrient absorption.

In agriculture, probiotic feed additives are replacing antibiotics to promote growth, digestion, and disease resistance in poultry, swine, and cattle.

This shift is partly driven by global regulations limiting antibiotic use in animal farming and rising demand for antibiotic-free meat and dairy.

Human Probiotics:

This is the cornerstone of the probiotics market, encompassing a wide range of health targets. Beyond digestion, modern probiotics are designed to support immune health, mental wellness (psychobiotics), skin health, and even metabolic function.

As interest in clean-label and scientifically supported supplements continues to rise, probiotics are evolving—and in response, more personalized solutions are emerging for women’s health, older adults, and athletes.

7. Are Probiotics also popular in children?

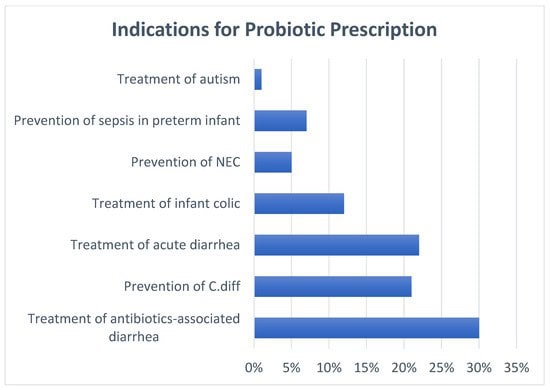

Surprisingly, they are! Ninety-seven percent of healthcare providers shared that families have asked about probiotics, reflecting growing interest among parents.

About 62% of pediatric providers reported prescribing them, most often for antibiotic-associated diarrhea, followed by acute diarrhea and the prevention of Clostridioides difficile infection.

When it came to product choice, 57% had no strong preference between single- or multi-strain probiotics. While only 17% would recommend a formula brand with added probiotics, and 82% favored over-the-counter options.

Additionally, 68% of providers said they would advise families to continue using probiotics if they had already started

While prescribing habits vary, most pediatric providers are open to probiotic use, especially for common digestive issues and tend to support continued use when families are already on board.

By Distribution Channel:

Supermarkets/Hypermarkets: Still the #1 place people buy probiotic foods — especially yogurts and drinks.

Pharmacies/Drugstores: Trusted for probiotic supplements and targeted health products.

Online Stores: Fastest-growing channel, especially post-pandemic, with subscription models gaining popularity.

Specialty Stores: Niche health retailers are offering premium and personalized probiotic products.

Most Common Probiotics Dosage For Adults

There aren’t any specific guidelines on the right or wrong dosage for probiotic use in adults, especially because these products aren’t FDA approved.

According to the Office of Dietary Supplements, the WGO clarifies that the optimal dose for probiotics largely depends on the particular product and the strains used.

As a rule of thumb, it’s also best to follow the manufacturer’s recommended dose.

No matter if the product has 1 billion or 100 billion CFUs, the manufacturer will have their recommended dose printed on the label. It’s usually one capsule per day but can go as high as three or more.

Sometimes, you might experience some side effects during the first few days of use. You can take lower doses or less than the recommended dose per day until your gut gets accustomed to the new microbiome.